The Indian real estate sector is entering a decisive decade. By 2030, the industry will no longer be defined only by location and price—it will be shaped by technology adoption, sustainability-led development, and structured long-term growth. For investors, developers, and occupiers, the next five years will determine who leads and who lags.

This blog explores how Indian real estate will evolve by 2030, the key trends driving transformation, and what stakeholders must do to stay ahead.

The Growth Outlook: Indian Real Estate by 2030

India’s real estate market is projected to cross USD 1 trillion by 2030, contributing nearly 13–15% to India’s GDP. Rapid urbanisation, a young workforce, infrastructure expansion, and global capital inflows are accelerating this momentum.

Key growth drivers include:

- Urban population expected to exceed 600 million

- Rising disposable income and nuclear households

- Massive infrastructure push (metros, expressways, logistics corridors)

- India emerging as a global office and manufacturing hub

Residential, commercial, logistics, and mixed-use developments will all expand—but quality, transparency, and experience will matter more than scale alone.

Technology: The Backbone of Real Estate 2030

4

Technology (PropTech) will fundamentally reshape how real estate is bought, sold, leased, and managed.

1. AI & Data-Driven Decisions

- AI-based pricing, demand forecasting, and risk analysis

- Smarter site selection and feasibility studies

- Predictive maintenance for commercial assets

2. Virtual & Digital Transactions

- Virtual property tours and digital walkthroughs as standard

- Online documentation, e-stamping, and faster registrations

- Blockchain-enabled land records reducing fraud and disputes

3. Smart Buildings & Asset Management

- IoT-enabled buildings optimising energy, security, and space usage

- Tech-integrated offices improving productivity and tenant retention

- Real-time performance dashboards for investors and landlords

By 2030, tech-first developers and consultants will dominate market trust.

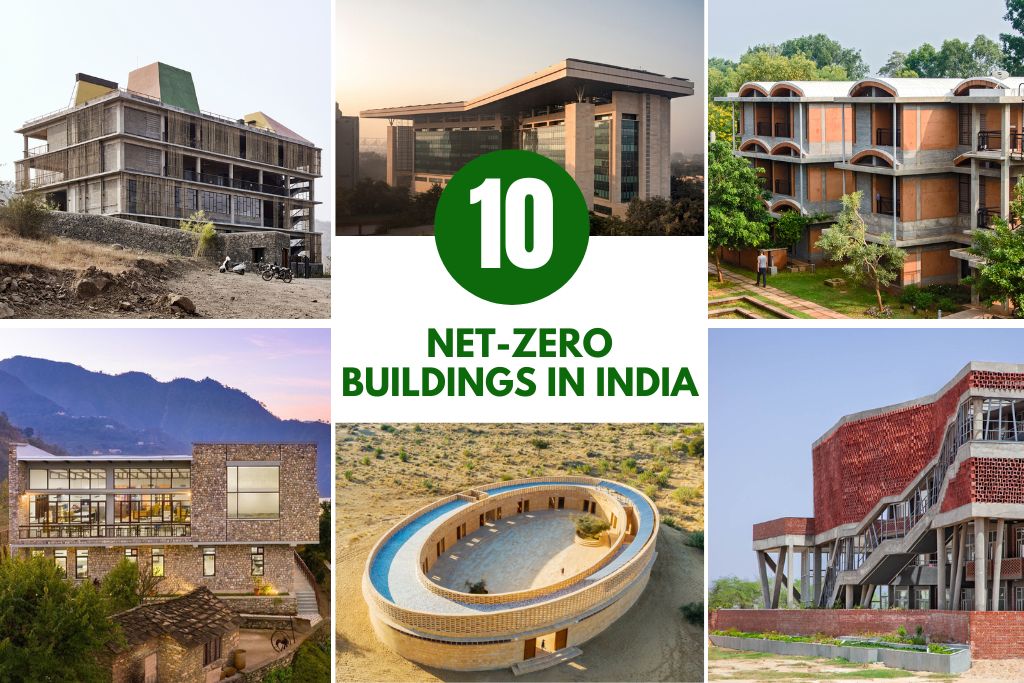

Sustainability: From “Optional” to “Non-Negotiable”

4

Sustainability will no longer be a branding exercise—it will be a regulatory, financial, and market necessity.

Green Is the New Premium

- Energy-efficient buildings command higher rentals and valuations

- Corporates prefer ESG-compliant office spaces

- Green-certified homes sell faster with lower lifecycle costs

Key Sustainability Trends by 2030

- Net-zero and low-carbon buildings

- Rainwater harvesting and water-positive projects

- Solar-integrated residential and commercial complexes

- Use of sustainable materials and waste management systems

Investors and occupiers will increasingly discount non-compliant assets, making sustainability critical for long-term portfolio value.

Sector-Wise Transformation by 2030

Residential Real Estate

- Demand for mid-income and premium housing remains strong

- Shift towards gated communities, wellness living, and smart homes

- Rental housing and co-living gain institutional participation

Commercial & Office Spaces

- Flexible workspaces and hybrid offices become mainstream

- Grade-A assets in Tier 1 and Tier 2 cities outperform

- Higher focus on employee experience, not just square footage

Logistics & Industrial Real Estate

- Fastest-growing segment driven by e-commerce and manufacturing

- Demand for warehousing near highways, ports, and consumption hubs

- REIT participation increases transparency and liquidity

Tier 2 & Emerging Cities

Cities like Noida, Greater Noida, Pune, Indore, Lucknow, Jaipur, and Coimbatore will see disproportionate growth due to affordability and infrastructure-led expansion.

Investment Trends: What Smart Capital Will Follow

By 2030, real estate investment in India will be:

- More institutional and less speculative

- Focused on yield + asset quality

- Structured through REITs, AIFs, and joint ventures

- Backed by long-term leasing and revenue visibility

Foreign investors, family offices, and domestic funds will favour professionally managed portfolios over fragmented holdings.

Challenges That Will Shape the Next Decade

Despite strong fundamentals, the sector must navigate:

- Land acquisition and regulatory delays

- Rising construction and financing costs

- Skill gaps in tech-enabled project execution

- Need for greater transparency at the micro-market level

Players who adapt early will convert these challenges into competitive advantages.

The Road Ahead: Who Will Win in Real Estate 2030?

The winners in Indian real estate by 2030 will be those who:

- Integrate technology across the asset lifecycle

- Build sustainable, future-ready developments

- Focus on long-term portfolio performance, not short-term gains

- Offer advisory-driven, data-backed decision-making

Real estate is no longer just about owning property—it’s about creating resilient, income-generating assets aligned with India’s growth story.

Final Thoughts

Indian real estate in 2030 will be smarter, greener, and more structured than ever before. Technology will drive efficiency, sustainability will define value, and growth will reward those who think long-term.

For investors, developers, and occupiers, the future belongs to those who prepare today.

Join The Discussion